Appearance

Configuring EU VAT with Specific Country Rates

This VAT collection method is an advanced option for businesses that are individually registered for VAT in each specific European Union (EU) country where they sell goods or services. It gives you granular control to manage tax rates on a country-by-country basis.

Who Should Use This Method?

You should select this option if your business meets the following criteria:

- You are registered for VAT in one or more specific EU countries.

- You do not use the simplified OSS (One Stop Shop) or the micro-business home country registration scheme.

This method is typically used by larger businesses or those with specific legal requirements to maintain separate VAT registrations.

How to Configure Specific Country Rates

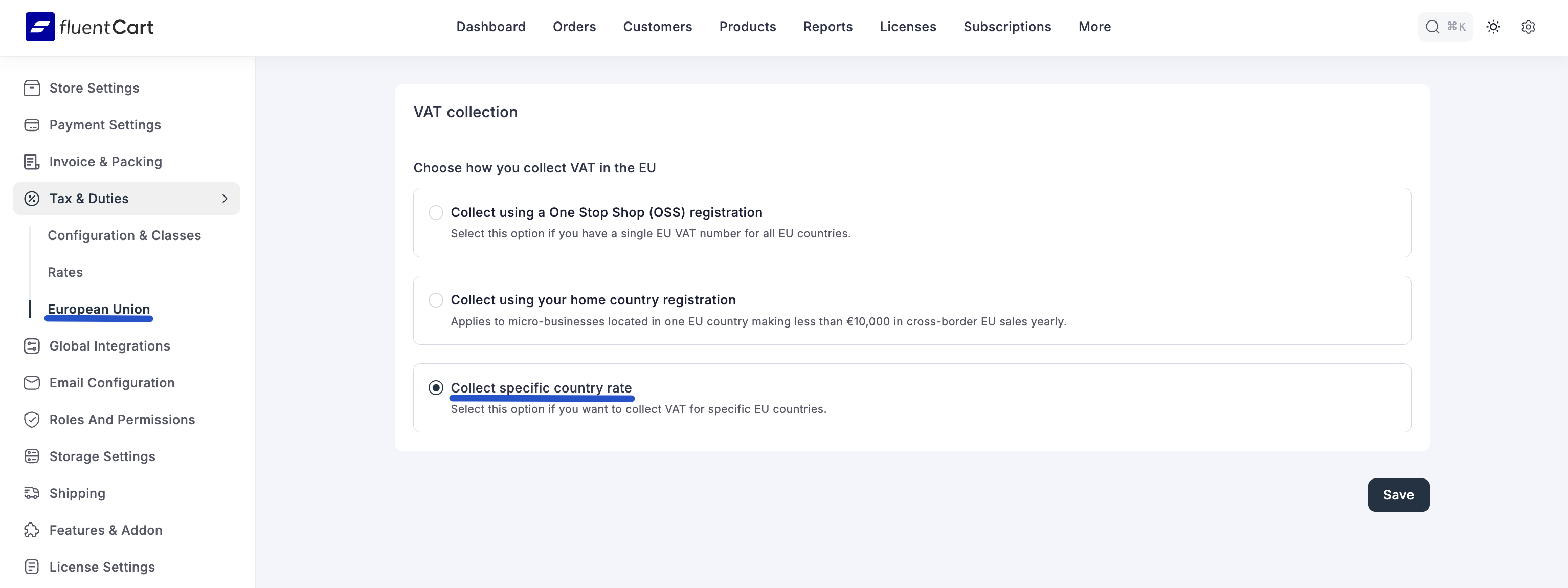

Select "Collect specific country rate" from the main EU VAT setup wizard, you will be taken to a configuration screen where you can choose the countries you are registered in.

Step 1: Configure Your Registered Countries

First, you need to tell FluentCart which EU countries you will be collecting VAT for.

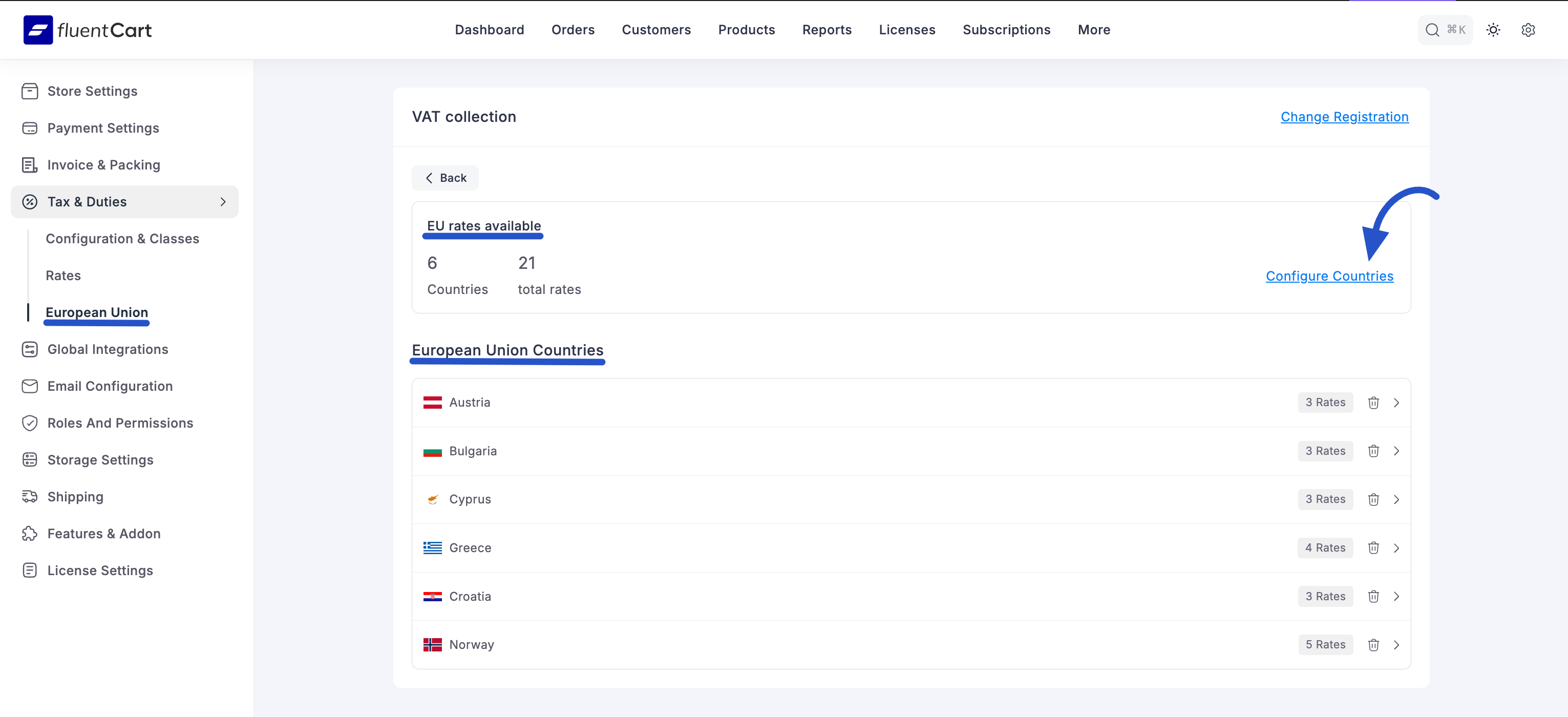

- On the "Collect specific country VAT" screen, click the Configure Countries button.

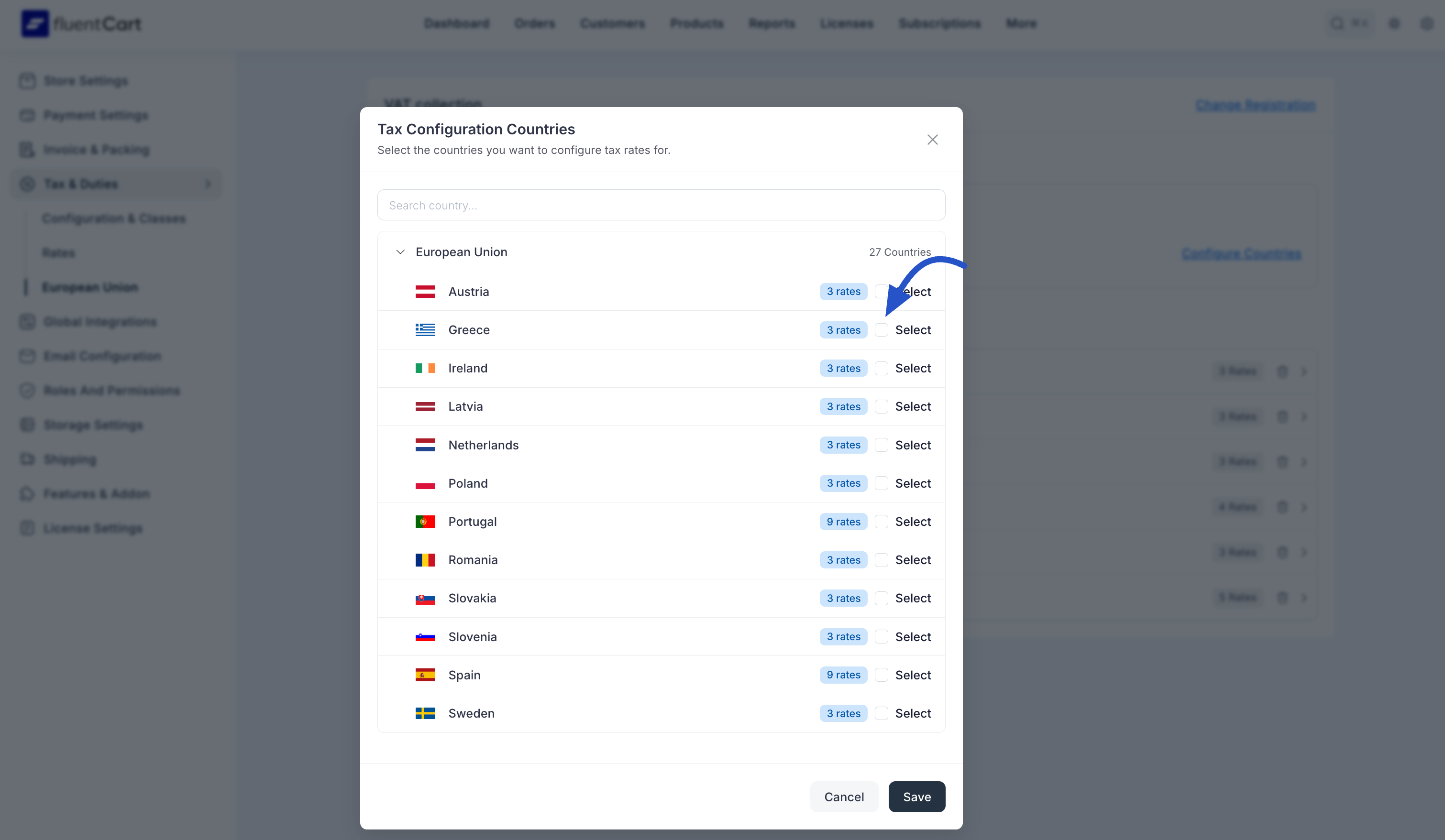

- A pop-up window will appear, listing all the countries in the European Union.

- Click the Select button next to each country where you have a VAT registration.

- Once you have selected all the relevant countries, close the pop-up.

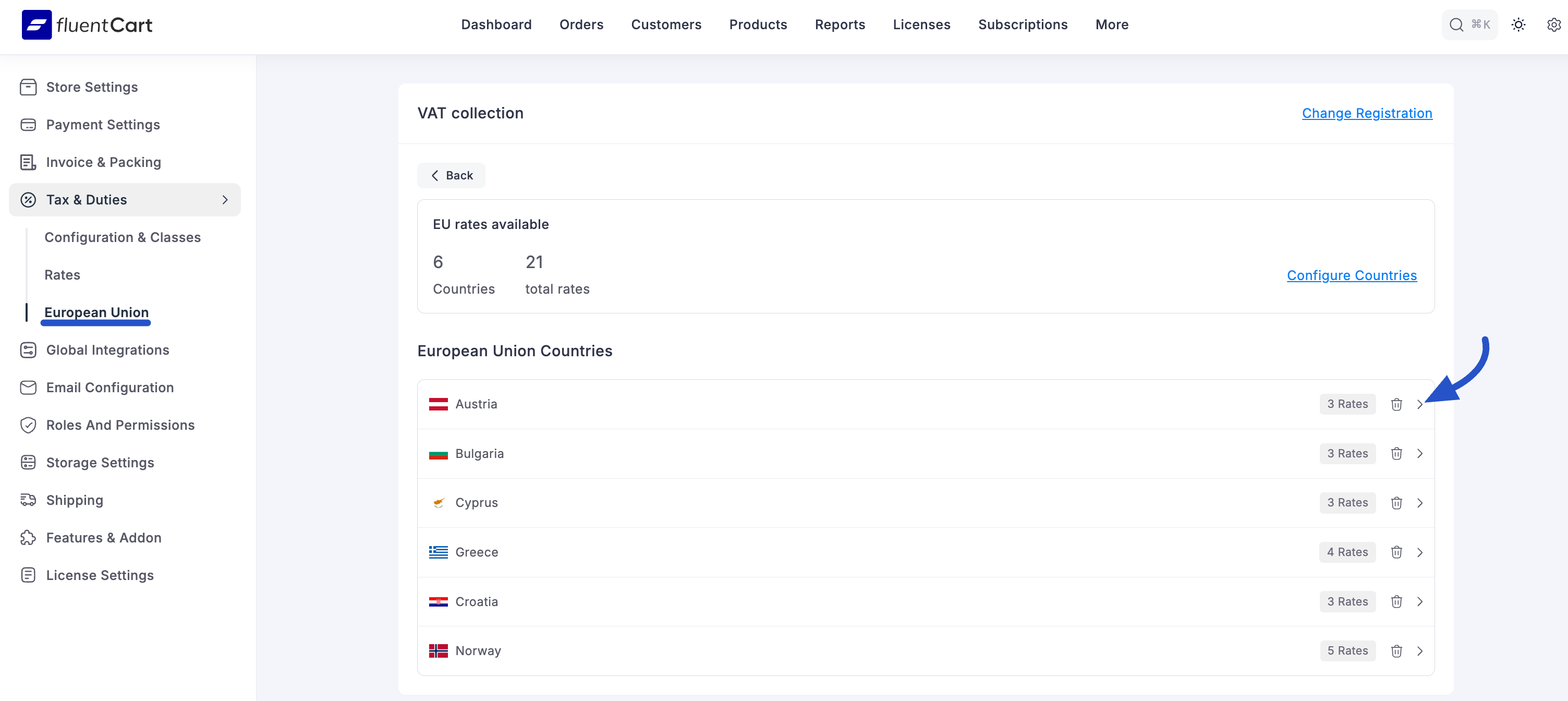

The countries you selected will now be listed on the main screen, ready for you to manage their individual tax rates.

Info To save you time, FluentCart comes with pre-configured default tax rates for many countries. After you select a country, you will often find that the standard tax rates have already been set up for you.

Step 2: Manage Tax Rates for a Specific Country

From the list of your configured countries, click the arrow icon for the country you wish to manage (e.g., Austria). This will take you to the detailed tax rate settings page for that country.

On this page, you can manage several key settings:

- Tax ID Enter your business's official VAT ID number for this specific country. This ID will be used on invoices and other legal documents for sales within this region. Click Save after entering it.

- Regional Settings This is where you define the primary tax rates for the selected country. You can add, edit, or delete rates as needed. To add a new rate, click the + Add New Rate button and configure the options (Tax Label, Rate, Tax Class, Compound, Priority).

- Shipping Tax Overrides This section allows you to set a different tax rate that applies only to shipping fees for specific provinces or states within the selected country. This is useful for regions with complex shipping tax laws.

- Action Buttons For every rate you create, you can use the Edit (pencil icon) and Delete (trash can icon) buttons to manage your tax rules easily.

By following this process for each country you are registered in, you can build a comprehensive and accurate tax system that is perfectly tailored to your business's specific VAT obligations.