Appearance

Configuring European Union (EU) VAT

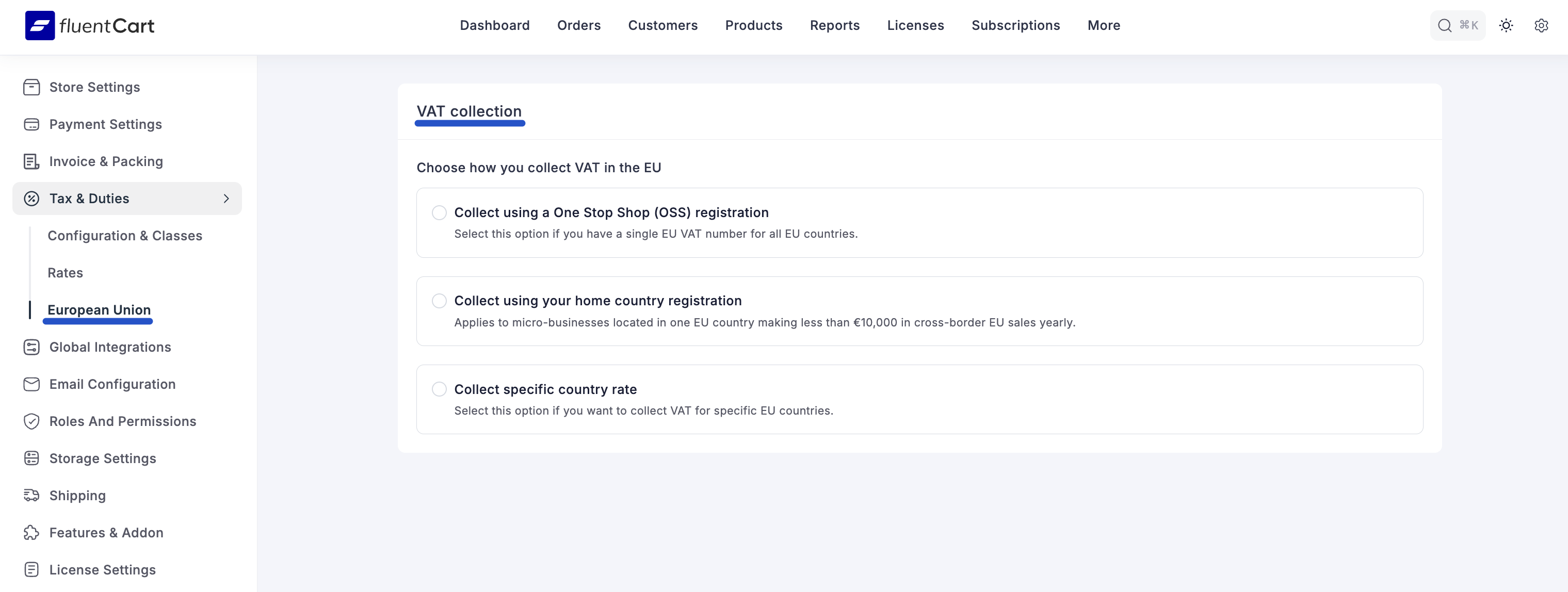

Selling to customers within the European Union (EU) requires careful handling of Value Added Tax (VAT). FluentCart provides a dedicated and powerful wizard to simplify EU VAT compliance, guiding you through the process of setting up your tax collection method based on your business type and registration.

Accessing EU VAT Settings

- From your WordPress dashboard, navigate to FluentCart Pro > Settings.

- Click on the Tax & Duties tab.

- From the sub-menu, select European Union.

Choosing Your VAT Collection Method

The first time you visit this screen, FluentCart will launch a setup wizard to help you choose how you want to collect VAT in the EU. This choice is crucial as it determines how tax rates are applied to your customers.

Here’s a breakdown of the three options to help you choose the right one for your business:

1. Collect using a One Stop Shop (OSS) registration

This is the most common and recommended method for businesses that sell to customers in multiple EU countries. The OSS system simplifies your VAT obligations by allowing you to declare and pay the VAT for all your EU sales through a single registration in one EU member state.

- Who it's for: Businesses of any size that have a single OSS VAT number and want to streamline their tax reporting for the entire EU.

2. Collect using your home country registration

This option is specifically designed for small and micro-businesses based within the EU that have a low volume of cross-border sales.

- Who it's for: EU-based micro-businesses with total cross-border EU sales of less than €10,000 per year. This allows you to apply your home country's VAT rate to all sales within the EU, simplifying your tax process significantly.

3. Collect specific country rate

This is an advanced method for businesses that are individually registered for VAT in each specific EU country where they sell goods or services.

- Who it's for: Larger businesses or those who prefer (or are required) to manage separate VAT registrations in each EU country they operate in.

Detailed Configuration Guides

Once you have selected the method that best fits your business, follow the detailed guide below to complete your setup:

- Configuring the OSS Method: Follow this guide if you have a single OSS VAT registration for all EU countries.

- Configuring with a Home Country Registration: Follow this guide if you are an EU-based micro-business selling less than €10,000 per year to other EU countries.

- Configuring Specific Country Rates: Follow this guide if you manage separate VAT registrations for each EU country you sell to.