Appearance

Configuring EU VAT with a Home Country Registration

This VAT collection method is specifically designed for small and micro-businesses based within the European Union (EU) that have a low volume of cross-border sales to other EU countries. It simplifies the tax process significantly by allowing you to apply your own country's VAT rate to all sales you make within the EU.

Who Should Use This Method?

You should select this option if your business meets the following criteria:

- Your business is located in an EU member state.

- Your total cross-border sales to other EU countries are less than €10,000 per year.

If you meet these requirements, you can use your local VAT registration to collect taxes, which is much simpler than managing an OSS registration or registering in multiple countries.

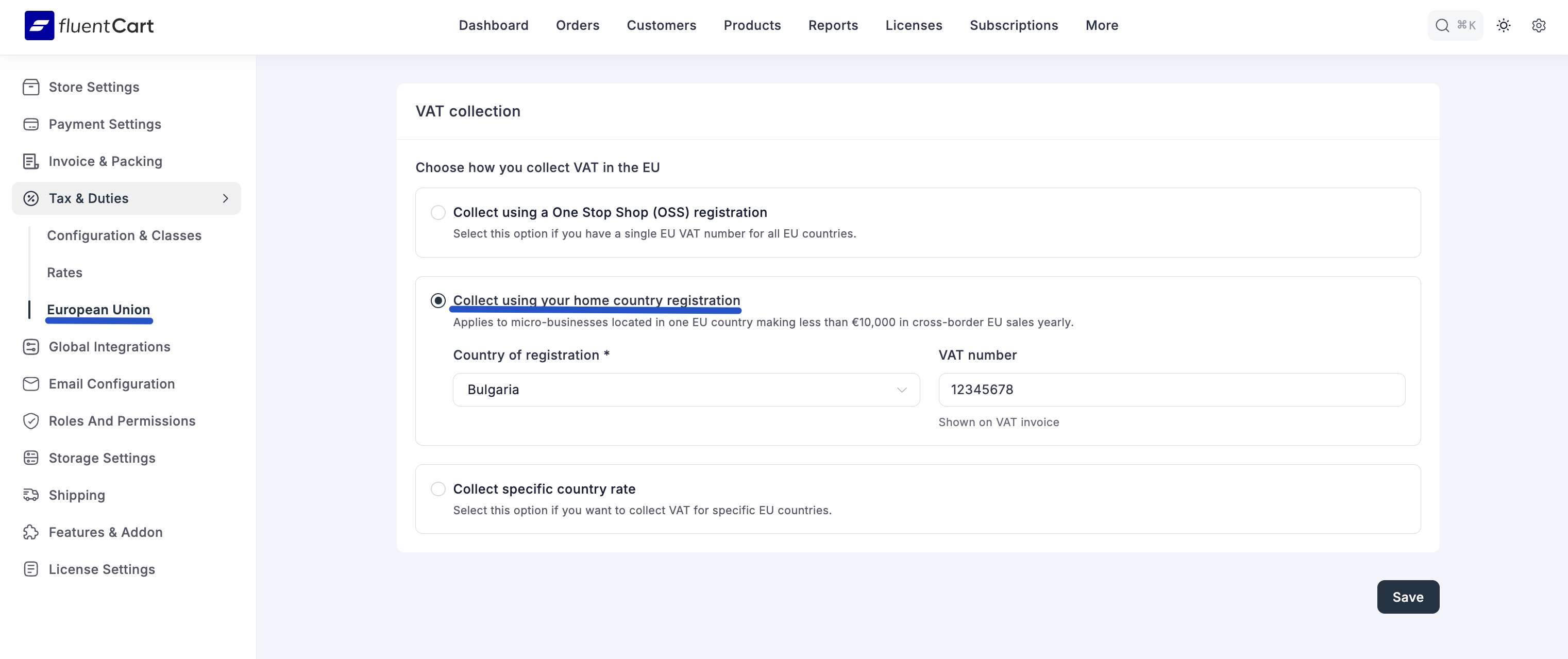

How to Configure Your Home Country Registration

If you selected "Collect using your home country registration" from the main EU VAT setup wizard, you will be taken to a simple configuration screen.

- Country of registration: From the dropdown menu, select the EU country where your business is officially registered for VAT.

- VAT number: Enter your local VAT number.

Click Save.

Once you save these settings, FluentCart will be configured to handle your EU VAT obligations correctly.

How It Works at Checkout

With this method active, FluentCart will automatically apply your home country's VAT rates to all sales made to customers in any EU member state. For example, if your business is registered in Austria and a customer from Germany makes a purchase, they will be charged the Austrian VAT rate, not the German one.

Managing Your Registration

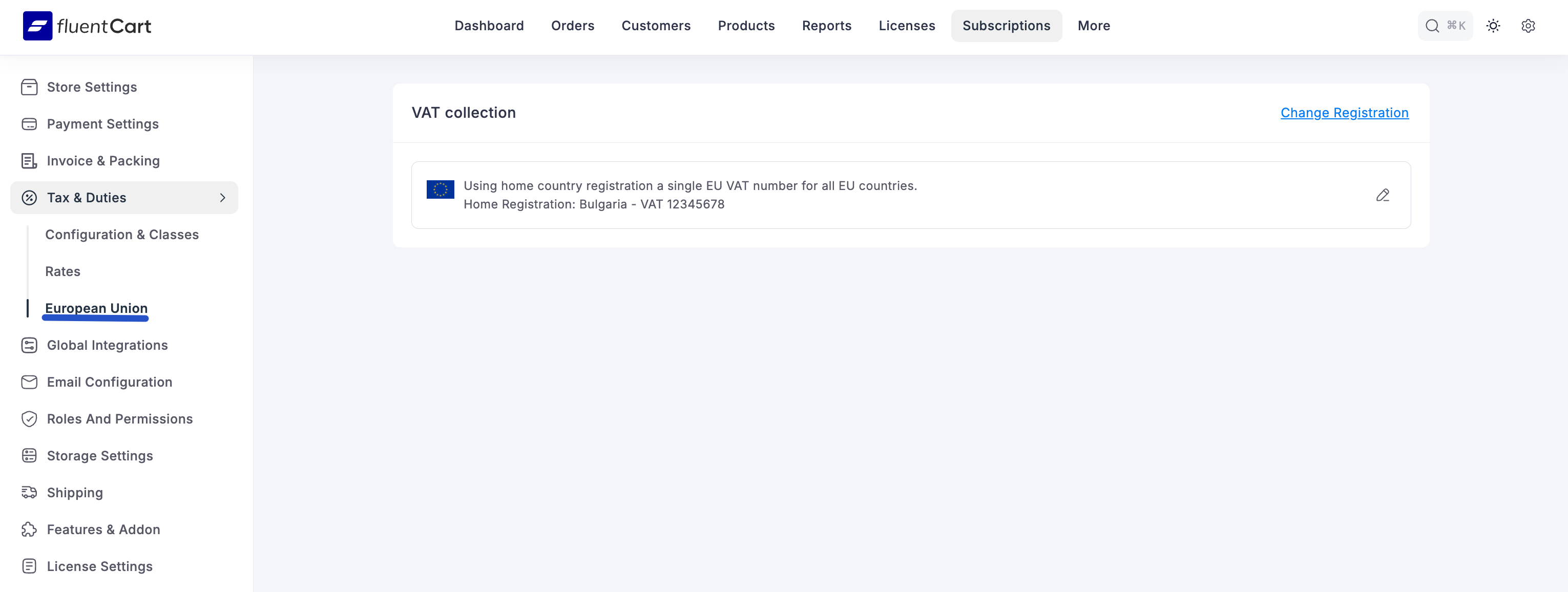

After the initial setup, you will be taken to the main EU VAT dashboard. Here, you will see a summary of your active registration.

- Change Registration: If your business grows and your sales exceed the €10,000 threshold, you will need to switch to an OSS registration. You can click the Change Registration link to return to the initial setup wizard and select a different VAT collection method.

- Edit: If you need to update your VAT number or change your country of registration, you can click the Edit button to modify your existing settings.